The Shortfalls of Oklahoma’s Defined Benefit Public Pension Plans

November 19, 2014

Tulsa Pension System Is Underestimating Its Debt and Investment Risk by Millions

Substantive, structural reform to the way Tulsa offers retirement benefits to its city employees is necessary in the immediate future in order to prevent these fiscal challenges from overwhelming the city budget and weighing down heavily on Tulsa taxpayers.

Adobe Acrobat document [1.3 MB]

August 13, 2014

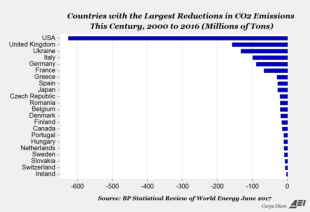

Expectations of future policy changes, including tax increases and reduced government services, can affect the business climate and labor market within a state. Unfunded public pension liabilities represent a significant source of concern, especially given the guaranteed nature of pension benefits to retirees. Current government statistics obfuscate the underfunding of public pensions. A proper accounting of public pension liabilities shows an increased risk of tax increases and reduced government services. Unfunded public pension obligations are not the only source of such policy changes, but they remain a significant threat to the states’ fiscal health and therefore to the business climate and labor markets within the states. Due to ongoing changes in state pension programs, a slow but continuing economic recovery, and the advent of new accounting rules, this underscores the need for wide-ranging pension reform that assures proper funding of pensions well into the future.

Adobe Acrobat document [1.0 MB]

March 20, 2014

Across the country, unfunded public pension liabilities are the single largest threat to the stability and solvency of state and municipal governments. According to 2013 valuations, Oklahoma’s six active defined benefit plans, plus the Wildlife Conservation Retirement Plan, which was recently closed to new members, carry an $11.4 billion unfunded liability. They have a combined funded ratio of 66.5 percent. This unfunded liability exceeds the state-appropriated budget by 52 percent. A more accurate accounting suggests that the problem is actually more serious—Oklahoma’s public pension systems have a $43.7 billion unfunded liability. Fortunately, there is a solution that allows Oklahoma to keep its promises to current employees and retirees, protect taxpayers and communities, and ensure long-term fiscal health. The state should close its defined benefit pension systems to new members and instead institute a defined contribution (DC) alternative. A DC plan would give new employees a secure retirement.

Adobe Acrobat document [2.6 MB]