New: The United States’ Corporate Income Tax Rate is Now More in Line with Those Levied by Other Major Nations https://t.co/SMXSCdjOoa @kpomerleau pic.twitter.com/7hzEhxrkf5

— Tax Foundation (@taxfoundation) February 12, 2018

November 4, 2017

June 12, 2017

Why Temporary Corporate Income Tax Cuts Won’t Generate Much Growth

April 19, 2016

August 31, 2015

How Corporations Are Taxed (From National Center for Policy Analysis - James P. Angelini, David G. Tuerck)

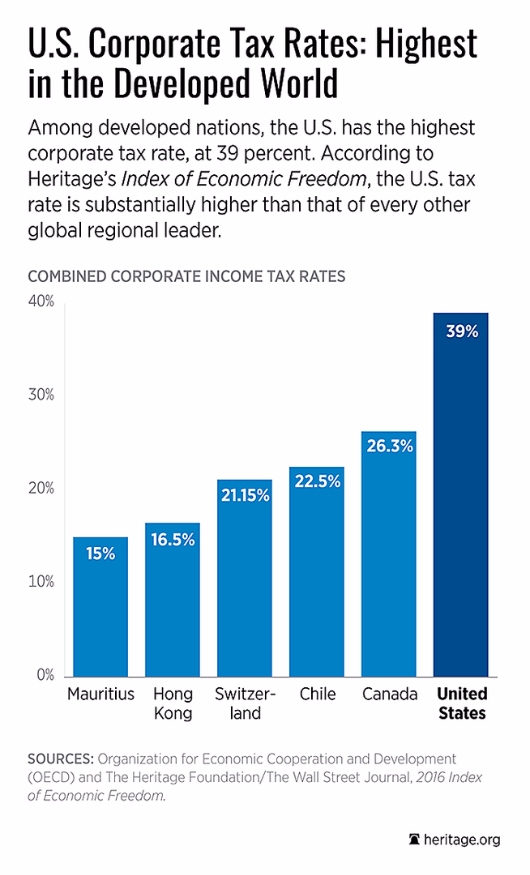

There appears to be agreement in principle that U.S. corporate tax rates are too high. The top U.S. corporate income tax rate is 35 percent—the highest in the world among developed countries. However, some small businesses face a 39.6 percent tax rate because, as sole proprietorships or partnerships, they are taxed at the highest personal income tax rate of 39.6 percent. Corporate taxes are so high largely because corporations are an easy target for raising revenue. The corporate income tax represents about 14 percent of total federal tax revenue, including taxes on profits before and after they are distributed to owners and shareholders—so-called double taxation.

July 10, 2015

The Greeks are whining about their high level of taxation (much of which goes uncollected), yet their top corporate rate is 26% while the top rate in the United States is 40% !!

February 06, 2015

U.S. Corporate Taxation: Prime for Reform

The U.S. has the second highest marginal effective tax rate on corporate investment in the developed world at 35.3 percent, with France having the only higher rate. While the U.S.’s marginal effective tax rate has remained stagnant around 35 percent over the last 10 years, the average marginal effective tax rate on corporate investment has fallen by 2.9 percent in the OECD and 6.7 percent in the G7. The lack of U.S. corporate tax competitiveness reduces investment and economic growth, undermines productivity, and encourages companies to move business to other countries. Options to reform the U.S. corporate tax code include reducing the top rate to 25 percent, limiting tax preferences, moving to a territorial tax system, and improving the integration of the individual and corporate tax codes.

Adobe Acrobat document [617.5 KB]

January 30, 2015

Options for Corporate Capital Cost Recovery: Tax Rates and Depreciation

The US tax code requires most new purchases of capital, such as machines and buildings, to be deducted from total revenue over the course of many years. This is called “depreciation” or “capital cost recovery.” While depreciation helps communicate profitability to shareholders, it distorts the profitability of capital investments when applied to the tax code, because businesses make investment decisions based on after-tax profitability, which is directly impacted by how an asset is depreciated. Expensing would be a more efficient tax rule than depreciation. Switching from depreciation to expensing could lower public and private administrative costs by simplifying the tax code. Because expensing makes investment relatively more attractive, switching to expensing would promote positive economic growth.

Adobe Acrobat document [240.2 KB]

August 21, 2014

Corporate Income Tax Rates around the World, 2014

The United States has the third highest general top marginal corporate income tax rate in the world at 39.1 percent, exceeded only by Chad and the United Arab Emirates. The worldwide average top corporate income tax rate is 22.6 percent (30.6 percent weighted by GDP). By region, Europe has the lowest average corporate tax rate at 18.6 percent (26.3 percent weighted by GDP); Africa has the highest average tax rate at 29.1 percent. Larger, more industrialized countries tend to have higher corporate income tax rates than developing countries. The worldwide (simple) average top corporate tax rate has declined over the past decade from 29.5 percent to 22.6 percent. Every region in the world has seen a decline in their average corporate tax rate in the past decade.

Adobe Acrobat document [1.9 MB]