Blog

If people would merely "roll over" and acquiesce to higher overll levels of taxation, could we tax ourselves right into prosperity ??

— Greg Karnes (@realGregKarnes) February 4, 2019

2018 tax returns will be more complex for many business owners & investors. https://t.co/ySUeiBTcsa

— Greg Karnes (@realGregKarnes) December 22, 2018

Proposed corporate rate hike would damage economic output: https://t.co/DaoECRiUUM @ericadyork #investment pic.twitter.com/FUtu1qAkGi

— Tax Foundation (@taxfoundation) October 15, 2018

With the Okla itemized deductions being capped at $17,000 (excluding charitable and medical) effectively Okla is going to tax gambling winnings. (i.e if you have wins/loses of $1 M each year & since losses are capped at $17,000, Okla tax on winnings increase by $50 K over 2017)

— Greg Karnes (@realGregKarnes) September 21, 2018

Reducing capital gains taxes greatly increases the incentive to sell assets. We estimate that this effect offsets the vast majority of the cost in the first year.https://t.co/frdP5h535G pic.twitter.com/k3e3lb6puc

— Kyle Pomerleau (@kpomerleau) September 4, 2018

Evidence shows the corporate income tax is the most harmful tax for economic growth and, despite what many think, workers bare a sizeable portion of its burden.

— Tax Foundation (@taxfoundation) August 14, 2018

Here are the economics behind the corporate tax. https://t.co/48rz1dImIM pic.twitter.com/JPy4uZ9qkj

Tax exemptions which serve only to advantage favored industries, and not to help approach a proper definition of taxable income, tend to be regressive as well as economically inefficient.

— Tax Foundation (@taxfoundation) August 10, 2018

Testimony: #Washington's Business Tax Structure: https://t.co/J9cA2NjP5F @JaredWalczak pic.twitter.com/ftzabBfY28

Tax bill likely lower for 2018, but you could still owe money on April 15th. More Americans may owe the IRS next tax season https://t.co/0bMe25TzYl #FoxBusiness

— Greg Karnes (@realGregKarnes) August 6, 2018

How to stop Google from tracking and targeting you with ads on https://t.co/2cVAR9Dn1m. You should #GoKomando too. .https://t.co/O8Wd4voiVm title=

— Greg Karnes (@realGregKarnes) August 4, 2018

This has been my general observation as well. 30 million people are not withholding enough for taxes. How to tell if you’re one of them https://t.co/EbxXumeVRc

— Greg Karnes (@realGregKarnes) August 1, 2018

How many jobs will the #TaxCutsandJobsAct create in your state this year?

— Tax Foundation (@taxfoundation) July 23, 2018

Check out our new state-by-state analysis of federal #TaxReform from @NKaeding and @kpomerleau here: https://t.co/j4mxHYmS9J pic.twitter.com/F7H148QEE5

We updated our analysis of the state-by-state jobs impact of the #TaxCutsandJobsAct.

— Tax Foundation (@taxfoundation) July 19, 2018

States with the most full-time equivalent jobs added in 2018:#California (24,701)#Texas (18,128)#NewYork (13,897)

See the full state list here: https://t.co/y2Kdn2tHXJ @NKaeding @kpomerleau

Changes to health savings accounts (HSAs) and the #ACA's "Cadillac Tax" may be on their way, according to recent @WaysandMeansGOP mark-ups.@ericadyork shares more of the possible changes here: https://t.co/4DUlgQvcPL #healthcare

— Tax Foundation (@taxfoundation) July 18, 2018

Internet purchases just became more expensive

Because of a drafting error in the Tax Cuts and Jobs Act (TCJA), restaurant and retail owners should attempt to delay any large remodeling projects. Until the law is corrected, the cost of those projects will have to be written off over 39 years, which is even worse than under prior law, when they could be written off over 15 years. This oversight will increase your after-tax cost of the remodeling project.

Exploring one of the worst government scandals in recent history: IRS targeting. Catherine Engelbrecht says her nonprofit voting rights group was unfairly singled out. #sharylattkisson #IRS #scandal pic.twitter.com/08MfzRAgoq

— Full Measure News (@FullMeasureNews) June 8, 2018

June 5, 2018

Over the last few weeks it has become pretty clear to me that the new withholding tables for W-2, 1099-R and 1099-SSA clients will leave them underpaid by the end of the year. The overall aspect of the“Tax Cuts and Jobs Act of 2017” results in lesser income tax for nearly everyone, but the tables give the tax back during the year rather than at refund time. Because many, many clients rely on the annual tax refund, I am worried that they will be shocked and upset when their refund is not a refund!

Avoiding Identity Theft-Individuals

- The IRS never initiates correspondence via email. Do not click on any links, open or respond to any email that claims to be from the IRS,

- Install and maintain a powerful anti-virus and firewall software system,

- Review your credit report annually and block it from new credit requests if acceptable. It is available annually for free at www.annualcreditreport.com or 877-322-8228

- Do not give anyone your social security number under almost any circumstances,

- Destroy (shred) any old checks reflecting your social security number,

- Buy and use a quality home shredder to shred all personally identifiable documents at all times,

- Establish an annual policy as follows: photocopy all credit cards front and back and place dated copies in a safe or lockbox, establish all website logins and save in a secure manner; change all passwords every year over the holidays and record in a secure manner,

- Secure all electronic files and paper files from intruders, children and outsiders

- Carefully guard against filling out any online forms and do not open accounts with anyone requiring social security numbers online,

- File returns as soon as possible for decedents, young children and other highly subject taxpayers.

We doubt anyone told #8 on our list that accountants were boring! pic.twitter.com/icTurUpxjN

— TaxSpeaker.com (@TaxSpeakerLLC) April 20, 2018

Sennheiser Set 840 Review

One of the most common questions all CPAs receive is “Do I have to Pay Tax on That?” The general rule of course is that you must pay tax on all sources of income, unless it is specifically excluded by law (The Internal Revenue Code). Shown below is an incomplete list of income items to be excluded from taxable income. I will always miss some things, but this will give you a simple list of everything I could come up with off the top-of-my head, plus several others. There are rules that must be met for many of these items to be tax-free, for which I refer you to the appropriate IRS Code Section.

Adult Foster Care Payments (IRC Sec. 131(a))

Agricultural Cost Sharing Program Payments (IRC Sec. 126)

Certain Military Benefits (IRC Sec. 122 and 134)

Child Support (IRC Sec. 71)

COBRA Premium Assistance (IRC Sec. 139C)

Combat Zone Pay (IRC Sec. 112)

Debt Forgiveness (Some) (IRC Sec. 108)

Energy Conservation Subsidies (IRC Sec. 136)

Federal Tax Refunds

Foster Care Payments for Minors (IRC Sec. 131(a))

Fringe Benefits (Qualified) Provided by Employers (IRC Sec. 105, 106, 119, 125, 127, 129, 132 and 137)

Gain on Sale of Home (IRC Sec. 121)

Gifts (IRC Sec. 102)

Health Savings and Medical Savings accounts used for Medical Bills (IRC Sec. 139 and 225)

Indian Healthcare and Welfare Benefits (IRC Sec. 139D and E)

Improvements by Lessee on Lessor’s Property (IRC Sec. 109)

Inheritances (IRC Sec. 102)

Interest Income from Municipal Bonds (IRC Sec. 103 and 115)

Life Insurance (IRC Sec. 101)

Living Expenses Paid by Insurance (IRC Sec. 123)

Military Retirement from Foreign Countries by Treaty (See Country Treaty with USA)

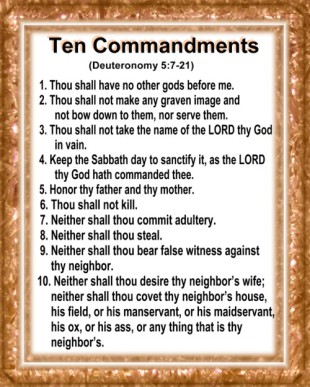

Minister Housing Allowance (Subject to SE Tax, however) (IRC Sec. 107)

Physical Personal Injury Lawsuit Awards (IRC Sec. 104)

Recovery of Tax Benefit Items (IRC Sec. 111)

Rental of Personal Residence for <15 days annually (IRC Sec. 280A)

Return of Basis Dividends on Form 1099-DIV

Return of Principal on Bonds

Roth IRA Distributions (IRC Sec. 408)

Savings Bonds Cashed for College (IRC Sec. 135)

Scholarships (Some) (IRC Sec. 117)

Volunteer Firefighter and EMT Property Tax Reduction (IRC Sec. 139B)

Worker’s Compensation (IRC Sec. 104)

Wrongful Imprisonment (IRC Sec. 139F)

For you geniuses that spend your time at the horse track and think you are pulling a fast one on the IRS by picking up losing tickets up off the floor and claiming a gambling loss, the IRS is on to you !! The first thing they are trained to look for on an audit are footprints on the losing tickets. Be honest !! There are enough legitimate tax planning strategies out there without having to resort to deceitful practices !!

Nationwide, taxes make up 18.5 percent of the average U.S. customer’s cell phone bill. https://t.co/fiyN6hb8gi @jbhenchman @ScottDrenkard pic.twitter.com/cUD41l0exr

— Tax Foundation (@taxfoundation) November 17, 2017

We ran the taxes of 9 example households to see how the Senate Tax Cuts & Jobs Act would impact real taxpayers: https://t.co/P2PoaOI99p @JaredWalczak @aelsibaie #TCJA #TaxReform pic.twitter.com/JH75eqE28Y

— Tax Foundation (@taxfoundation) November 15, 2017

Illustration Of The Modern-Day American Progressive Tax System

For years, every Wednesday afternoon, 10 friends congregated at the local tavern for beer. The weekly bar bill was $100, and the friends agreed to pay the tab as we pay our taxes, so their payments looked like this:

The first four friends (the poorest) paid nothing. The fifth friend paid $1. The sixth paid $3. The seventh paid $7. The eighth paid $12. The ninth paid $18. And the 10th friend (the richest) paid $59.

These 10 friends were quite happy with their bill-sharing custom for a decade, until the bar's owner threw them a curveball. "Seeing as you alcoholics are such good customers," he told them, "I'm going to reduce the cost of your weekly beer by $20." Now drinks for the 10 friends would cost $80 a week.

The friends still wanted to pay their bill the way we pay our taxes, so the first four friends were not affected. They'd still drink free. But what about the remaining six friends? How could they divide this windfall so that each would get his fair share? They realized that $20 divided among six people is $3.33 each. But if they subtracted $3.33 from everybody's share, the fifth and sixth friends would be paid to drink their beers. So they asked their congressman for advice. The congressman suggested that it would be fair to reduce each friend's tab by a higher percentage the poorer he was, following the tax system they'd been using. Then he proceeded to work out the amount that each should now pay.

The fifth friend, like the first four, now paid nothing. That's a 100% savings. The sixth friend now paid $2 rather than $3, saving 33 %. The seventh friend now paid $5 instead of $7, saving 28 %. The eighth now paid $9 instead of $12, saving 25 %. The ninth friend now paid $14 rather than $18, saving 22 %. And the 10th friend now paid $49 instead of $59, saving 16%.

Six of the friends were now better off than before, while the first four continued to drink free. But after a couple of weeks, the friends began to compare their savings. "I only got $1 out of the $20 that we saved," declared the sixth friend. He pointed to the 10th friend. "But he got $10." "That's true," exclaimed the fifth man. "That's unfair. Why should he get 10 times more ben¬efit than I get?" "That's right," said the seventh friend. "Why should he get $10 back when I only get $2? The wealthy get all the breaks!"

"Wait a minute!" yelled the first four men in unison. "We got nothing. This new tax system exploits the poor!"

On Tuesday, the nine lowest-earning friends visited the 1oth friend at home, called him outside, kicked his butt, and then went home. On Wednesday afternoon, the 10th friend didn't show up for beer, so the nine friends sat down and had their beers without him. But when it came time to pay the bar bill, they discovered something: They didn't have enough money among them to pay for even half their beer tab.

And that my friends, is how the modern-day American progressive tax system functions in the real world.

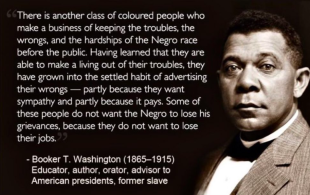

The Lowering Of Standards In The United States

The following is a summary of a recent article by Chris Sperry, a prominent baseball consultant.

In 1996, one of the most storied high school and college baseball coaches, John Scolinos, spoke to a convention of more than 4,000 baseball coaches in Nashville, Tennessee. Scolinos, who had retired from coaching in 1991, shuffled to the stage and received a standing ovation. He wore a string around his neck, from which hung a full-size home plate.

Scolinos spoke for 25 minutes before referring to his home plate necklace. He was mindful of the snickering among some of the coaches and then reproachfully said, "You're probably all wondering why I'm wearing home plate on my neck." He continued, "I may be old, but I'm not crazy. The reason I stand before you today is to share with you baseball people ... what I've learned about home plate in my 78 years." Then he asked: "Do you know how wide home plate is in Little League?"

After a pause, someone said, "17 inches." Scolinos then asked, "How about in Babe Ruth's day?" There was a long pause, and another reluctant coach said, "17 inches."

"Right," said Scolinos. "Now, how many high school coaches do we have in the room?" Hundreds of hands went up. "How wide is home plate in high school baseball?"

"Seventeen inches," they exclaimed in unison.

"And you college coaches, how wide is home plate in college?"

"Seventeen inches!"

"Any minor league coaches here? How wide is home plate in pro ball?"

"Seventeen inches!"

"Right!" Scolinos said. And then he asked about the major leagues, confirming that it's 17 inches there, too. "And what do they do with a big-league pitcher who can't throw the ball over 17 inches?" After a pause, he answered himself: "They send him to Pocatello!" The coaches laughed. "What they don't do is ... say, 'Ah, that's OK, Jimmy. You can't hit a 17-inch target? ... We'll make it 20 inches so you have a better chance of hitting it. If you can't hit that, let us know so we can make it wider still, say 25 inches." He continued: "Coaches, what do we do when our best player shows up late to practice? When our team rules forbid facial hair and a guy shows up unshaven? ... Do we hold him accountable? Or do we change the rules to fit him? Do we widen home plate?"

The laughter faded as Scolinos' message became clear.

Scolinos made a drawing of a house on the home plate around his neck with a marker. "This is the problem in our homes today, with our marriages, with the way we parent our kids, with our discipline. We don't teach accountability to our kids, and there is no consequence for failing to meet standards. We widen the plate."

Then he drew an American flag on top of the house. "This is the problem in our schools today. The quality of our education is going downhill fast, and teachers have been stripped of the tools they need to be successful. ... We are allowing others to widen home plate."

Scolinos concluded: "If I am lucky, you will remember one thing from this old coach today. It is this: If we fail to hold ourselves to a higher standard, a standard of what we know to be right, if we fail to hold our spouses and our children to the same standards, if we are unwilling or unable to provide a consequence when they do not meet the standard and if our schools and churches and our government fail to hold themselves accountable to those they serve, there is but one thing to look forward to." He held home plate in front of his chest and presented its black backside. "Dark days ahead."

This is what our country has become, and it's wrong. Go out there and fix it. Don't widen the plate.

John Scolinos passed away in 2009 at the age of 91

Tech News