May 3, 2014

Every now and then we hear about high speed rail in Oklahoma. We may want to consider the experience in England and other areas before proceeding. The economic transformation of the North of England is central to the government’s promotion of the High Speed 2 rail line (HS2). It claims that the new line would boost employment and address the North-South divide, but there is reason for skepticism. Policymakers made similar claims prior to the use of High Speed 1 for fast domestic services to East Kent. Yet, since the introduction of high-speed services, East Kent has performed far worse in terms of employment than the rest of the South East and Britain. Some parts of the area now have similar employment rates to depressed old northern industrial cities. It would appear that the impact has been too small to counteract other more important economic factors, including the very large tax bill, relatively low levels of human capital in locations on the route, and a risk that disruptive technologies will undermine many of the purported benefits.

Adobe Acrobat document [803.7 KB]

December 7, 2013

Oklahoma has considered high speed rail service in the past. Before we get too serious, it might make sense to consider Florida’s experience. The Tampa to Orlando high-speed rail project was cancelled by Governor Rick Scott in 2011 to shield Florida taxpayers from billions of dollars in liabilities. Yet, a recent report for the Florida Department of Transportation (FDOT) estimated that the line could have earned an operating surplus of $38.0 million by 2026. International research indicates that passenger rail projects are characterized by optimism bias in ridership and revenue forecasts. On average, eventual ridership totals 39% below forecast. If the Tampa to Orlando high-speed rail had equaled the international average (which seems optimistic, given recent cost trends in the high-speed rail industry), the cost overrun would have been $1.2 billion (45%). These deficits would have been the responsibility of Florida taxpayers.

Adobe Acrobat document [298.6 KB]

- OKC Comm'l Projects in the News

- Marijuana

- Proposed Sales Tax On Services

- OKC Economic Accolades During Mayor Cornett's Tenure

- Oklahoma Medicaid Expansion

- Oklahoma's Underfunded Pension Problem

- High Speed Rail Service

- Common Core Standards

- State Tax Climate

- Oklahoma's Public Universities

- The RIED Report

- Okla 4th Congressional District

- Okla 5th Congressional District

- Oklahoma House District 87

Get in Touch With Me.

Call me at 405 810-8119 with any questions or to schedule an appointment.

Greg Karnes CPA

4301 NW 63rd St, Suite 200

Oklahoma City, OK 73116-1504

Or you may use my contact form.

Competitive Fee Structure

… but if you are looking for the cheapest fees, or obsessing about your correct pronouns or global warming/white privilege B.S., or unable to make up your mind as to whether you are a man or a woman, you would be so much happier working with someone else…

… in addition, due to an extremely hectic schedule, only serious inquiries may expect a response …

New tax clients are expected to provide copies of their last 3 years of tax returns and provide permission to contact prior accountant to resolve any issues, if necessary.

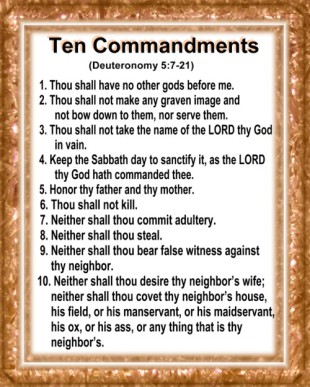

Regretfully, I am unable to accept new clients who have unfiled prior-year’s tax returns, who are not current with all prior tax obligations, are involved in any marijuana-related business ventures, use marijuana or illegal drugs, have any income from gambling, invest in cryptocurrency, are experiencing extreme financial difficulties, are personal-injury attorneys, in the construction industry or are in the country illegally. Newly formed businesses are frowned upon as well.

Though not required, supporters of President Donald J. Trump, Governor Kevin Stitt, the National Rifle Association & clients who are alpha males & females, ethical, hard-working, cheerful, optimistic and NOT easily offended are generally preferred.

Absolutely NO LAZY, TREE-HUGGING, CRITICAL RACE THEORY PROMOTING, ECONOMICALLY ILLITERATE, GODLESS, RIOTING, KNEELING, CENSORING, RACIALLY & GENDER OBSESSED, DR. SEUSS BOOK-BANNING, FIREARM CONFISCATING, BIG GOVERNMENT SOCIALISTS allowed beyond the front door, however!

Due to the alleged gang activity and drug dealing at the nearby Chelsea Manor Apts. & 7-11 Convenience Store, I would personally recommend "packing some heat" while in this area (and perhaps Penn Square Mall as well). Some believe the OKC Police Dept. has become too constrained and are hesitant to confront these gangbangers and put them behind bars where they rightfully belong. "Talk on the Street" seems to be that this emanates from an extremely weak & naive Mayor who purportedly suffers from a severe case of "Low T," a weak City Manager, a new, effeminate-looking Police Chief, who refuses to enforce our nation's immigration laws & a Ward 6 Council Girl who took her Oath Of Office using a book on Marxism.

Anyone that treats black Americans differently does so because @BarackObama has been saying that they are different for the last 10 years. The reality is, they are not and should not be. https://t.co/YxuH5rHjUW pic.twitter.com/0Et5yXEMl1

— Bernard B. Kerik (@BernardKerik) April 20, 2021

Calm Guide Sheet by Greg Karnes on Scribd

When you are hunting elephants, don’t get distracted chasing rabbits.

— T. Boone Pickens (@boonepickens) March 7, 2011

... coming from someone who should know! https://t.co/H2OwzJquyg via @TMZ_Sports

— Greg Karnes (@realGregKarnes) January 3, 2019

The duration of a mass shooting always depends on the arrival of the 2nd gun.

— longhorn_92 (@jaelvoet) December 30, 2019

And Democrats want to ban you from protecting yourself. Remember that next time you vote. pic.twitter.com/7N6GBPwYig

✅ An #ArmedCitizen saved multiple lives last night in #OKC. We hope this serves as a wake-up call for @GovMaryFallin, who just two weeks ago vetoed a constitutional carry bill. Just another example of how the best way to stop a bad guy with a gun is a good guy with a gun. #2A pic.twitter.com/kPRjpiyeow

— NRA (@NRA) May 25, 2018

Need to be a long-time Sooner football fan to appreciate.

— Greg Karnes (@realGregKarnes) February 22, 2020

Video taken 2 1/2 years ago in a friend's kitchen.

Former Sooner broadcaster John "Disco" Brooks & Marcus Dupree.

Also cameo by former Sooner/Sam Bradford's dad, Kent, & former Mayor Mick Cornett. pic.twitter.com/f5VZKxuvsm

Make The University of Oklahoma Great Again!

(Let us return to the time before the “Loudmouth Communist Snowflakes” and the less than competent financial administrators arrived on campus)

At the University of Oklahoma, the researchers found there were nearly nine registered Democrats for every one Republican on the faculty, and faculty gave $2 in campaign contributions to Democrats for every $1 given to Republicanshttps://t.co/l4Pzb3b5Q9

— Greg Karnes (@realGregKarnes) February 2, 2020

Citing Black Lives Matter, photos of retired white male professors to be taken down at U. Oklahoma

— Greg Karnes (@realGregKarnes) August 26, 2020

...I keep telling people that my alma mater has become a hotbed of Marxist thinking...

https://t.co/vutEDHcNpm

Are these ridiculous demands an inevitable consequence of my alma mater staffing the University with so many card-carrying Marxists?https://t.co/9LY2o7OsBr

— Greg Karnes (@realGregKarnes) August 10, 2020

Sadly, the University of Oklahoma is becoming a hotbed of Communist snowflakes.

— Greg Karnes (@realGregKarnes) September 27, 2019

Perhaps someday we can rebuild the University back to something that the football team can be proud of! https://t.co/Y0DrXXyUjN via @OUDaily

Looks to me some government employee violated the law. pic.twitter.com/5zOuXd8aei

— Mark Sharpton (@MarkSharpton) February 23, 2020

Pledge of Allegiance removed from OU undergraduate congressional agenda.

— Greg Karnes (@realGregKarnes) September 27, 2019

Student Philip Aldridge seems to have nailed it.https://t.co/DEtZId6xmP

Former OU volleyball player sues over exclusion from team because of Conservative political views

— Greg Karnes (@realGregKarnes) June 3, 2021

...my alma mater continues its trend towards forcing Marxist & radical views on the student body...hope she takes them to the cleanershttps://t.co/VSA5B60CZD

ODELL BECKHAM JR.

NOVEMBER 23, 2014

GREATEST CATCH EVER ??

RUSSELL WESTBROOK

FEBRUARY 16, 2015

NBA ALL STAR GAME MVP

41 POINTS

3RD MOST EVER SCORED

OU SOONER - SAMAJE PERINE

NOVEMBER 22, 2014

427 RUSHING YARDS

MOST EVER BY A COLLEGE RUNNING BACK

1/ Known for basketball prowess, Wayman Tisdale's 'further legacy is his love of God'

— Greg Karnes (@realGregKarnes) April 10, 2021

...saw this story in today's paper regarding Wayman Tisdale and couldn't help but be reminded of Toby Keith's tribute song to his friend...https://t.co/4RiPYofGB7

Top 10

Taxpayer Enemies

Those Individuals Or Groups Who Seem Most Intent On Penalizing Success & Achievement & Desiring A Return To The Days Of Low Economic Growth During The Jimmy Carter/Barry Obama - "Sleepy Joe" Biden Era

(in order, as of today)

“Since this is an era when many people are concerned about ‘fairness’ and ‘social justice,’ what is your ‘fair share’ of what someone else has worked for?”

— Thomas Sowell (@ThomasSowell) January 8, 2019

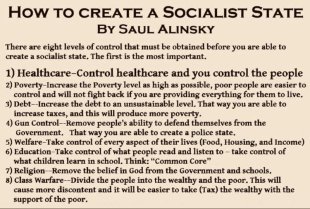

The Caracas Caucus

(the Top 10 “Americans” who seem most hell-bent on destroying our jobs & economy in order to advance the cause of centralized government control over our lives and private businesses to the point where we are forced to surrender our individual liberties to the state)

— Greg Karnes (@realGregKarnes) March 29, 2021

The Terrorist Caucus

Those Individuals Or Groups Who

Come Across To Me As Ambivalent Towards Islamic

Terror Activities

The "Soft On Crime"

"Hug-A-Thug" Caucus

The Top 10 Individuals Or Groups Who

Come Across To Me As Coddling The Criminal Element At The Expense Of The Public Safety Of Law-Abiding Citizens

The “Ugly” Caucus

The Top 10 Individuals On The Taxpayer Payroll That Strike Me As Being Just As Unattractive On The Inside As They Are On The Outside.

LOWER TAXES

=

HIGHER GOVERNMENT REVENUE

This should be simple enough for everyone to understand. pic.twitter.com/tWsu50ewvL

— Juanita Broaddrick (@atensnut) October 21, 2021