Latest Scoops On Tax

Policy

— Greg Karnes (@realGregKarnes) February 4, 2019

Richest 1,409 taxpayers pay more tax than bottom 70 MILLION... (yet some still claim the wealthy do not pay their "fair share" ... Individual income taxes are the federal government’s single biggest revenue source. https://t.co/gSY4KGxrZ4 via @BloombergQuint

— Greg Karnes (@realGregKarnes) October 15, 2018

It is time to “get real” with capital gains taxes.

— Tax Foundation (@taxfoundation) July 14, 2018

The purchase price of assets later sold for capital gains or losses continues to *not* be adjusted for inflation.

Read more on #capitalgains taxes here: https://t.co/cxYEdYgnC7 #trading

November 4, 2017

President Trump's Full Tax Reform Plan by Katie Pavlich on Scribd

September 27, 2017

President Trump’s Proposed Tax Plan

August 28, 2017

June 8, 2016

CBO: President Obama’s 2017 Budget Would Discourage Work, Savings

Tax proposals would hamper investment, pass on higher costs to consumers

April 16, 2016

February 23, 2016

A Blueprint for Balance: A Federal Budget for 2017 (From Paul Winfree – The Heritage Foundation)

October 8, 2015

Study - Government Workers Make 78 Percent More Than Private Sector (From Cato Institute – Chris Edwards)

Average pay and benefits $52,688 higher than non-gov’t employees

September 4, 2015

Surprising Results from Indiana’s Right-to-Work Law (From Buckeye Institute - Tom Lampman)

In 2012, Indiana became the 23 state to enact a “right-to-work” law that prohibits unions from forcing non-members to pay so-called “agency fees” as a condition of working at unionized firms. Supporters of right-to- work laws have argued that such laws promote freedom and labor rights by allowing workers to choose whether to financially support unions. Unions and other opponents of such legislation have disagreed, worrying that barring mandatory agency fees will ultimately lead to “union busting” and hurt union membership and spending. Indiana has been a right-to-work state for more than two years, and some surprising evidence collected by the U.S. Department of Labor now suggests that union claims are overblown.

September 4, 2015

Former Fed Chair Alan Greenspan says the real issue facing the U.S. is not the Fed's monetary policy but the nation's fiscal policy, most especially entitlement programs.

August 24, 2015

Who Benefits from Mortgage Deductions (From National Center for Policy Analysis - Pamela Villarreal, Matt Cafrelli, Joshua Latshaw)

Mortgage-related deductions benefit homebuyers who itemize, and income tax itemizers tend to be middle and higher income earners. However, these tax benefits could be tailored to reduce the cost of home ownership for families in the lowest income quintiles by making a limited tax credit available to non-itemizers.

June 30, 2015

US Federal Budget Restraint in the 1990s - A Success Story (From Mercatus Center – David Henderson)

A new study published by the Mercatus Center at George Mason University reviews the example of the 1990s to debunk some of Washington’s most frequently cited reasons why spending cannot be cut now. The economic and budgetary lesson from the decade is clear: it is possible to reduce federal government spending as a percent of Gross Domestic Product (GDP) by cutting some spending and restraining the growth of the rest. The political lesson equally clear: divided government may make spending cuts more difficult, but it does not render them impossible.

June 6, 2015

Running Out of Other People’s Money (From Cato Institute-Michael Tanner)

If a family were to live recklessly, running up their credit cards, and then leaving that debt for their children to pay, we would call them irresponsible. What, then, do we call politicians, from both political parties, who do the same thing on a much bigger scale?

June 03, 2015

Closing America’s Enormous Fiscal Gap

America faces an enormous fiscal gap. No adjustment that sufficiently addresses the US government’s enormous fiscal gap will be small. Different households will be affected differently by the adjustment, but all will see an increase in their lifetime tax burdens if the gap is closed solely through tax increases—and even a 6 percentage point tax hike would materially reduce a household’s welfare. Delaying the adjustment only increases the magnitude of the burden and shifts more of it onto future generations.

May 19, 2015

Dynamic Scoring and Congress

Dynamic scoring has been used without fanfare during earlier debates about immigration. The best argument for dynamic scoring is that it accurately reflects the fact that large pieces of legislation will affect the overall size of the economy. The arguments against dynamic scoring fall short. The process the Congressional Budget Office and the Joint Committee on Taxation use will be reported broadly and their work will continue to be backed by rigorous methodological transparency and statistical sophistication. Should one projection be inaccurate, all of the projections will be inaccurate, making it difficult to use the CBO or JCT estimates to favor particular policies.

May 08, 2015

The Child Tax Credit

First introduced in 1997, the Child Tax Credit (CTC) has grown in size and eligibility to become one of the single largest tax credits available to middle-class families. The CTC provides a significant subsidy to almost all tax- paying families with children, and the US federal and local tax codes contain many other provisions that subsidize child rearing. In the aggregate, the CTC subsidy to families with children has grown to nearly $60 billion, placing it among the list of the largest “tax expenditures”. This is a topic that requires much more scrutiny, primarily to determine if there is a social need for $1,000 more per child. One alternative is to remove the subsidy and lower tax rates by an offsetting amount, which would benefit all taxpayers. It would also provide social benefits in terms of increased productivity and economic growth, and this is the most relevant comparison to any social benefits from additional children.

April 07, 2015

A Tax Reform Primer for the 2016 Presidential Candidates

America needs tax reform. As the 2016 presidential campaign progresses, candidates seeking the presidency will increasingly face questions about how they would address federal tax policy—foremost among them, if they support tax reform and how they would implement it should they become President. There is clear public support for major tax reform: 71 percent of the American public believes that the U.S. tax system needs major changes and reform. Only 5 percent think the tax system is working just fine. Tax reform is a complicated issue that encompasses a wide variety of sub-issues with which candidates will need to grapple if they are to answer those questions effectively. This Heritage Foundation tax primer will help them prepare.

Adobe Acrobat document [204.7 KB]

March 12, 2015

Obama’s Proposed Capital Gains Tax Hike

Capital gains tax hikes do not just affect the wealthy; they affect anyone at any income level who needs access to capital. In today’s struggling entrepreneurial climate, policymakers can ill-afford to impose additional taxes on productive workers and small businesses, or reduce the rate of return on capital investment.

Adobe Acrobat document [469.7 KB]

March 11, 2015

7 Priorities for the 2016 Congressional Budget Resolution

The national debt exceeds $18 trillion and, absent spending reforms, will continue to grow. As a share of the economy, the national debt already exceeds the nation’s gross domestic product, with the part that is borrowed in credit markets making up nearly three-quarters of this debt. Massive and growing debt hinders economic growth and opportunity by discouraging investment and threatening higher future taxes to pay interest on the debt. Congress should put the budget on a path to balance with health care, retirement, and welfare reforms, while prioritizing national defense in the budget, cutting inappropriate and wasteful domestic spending, and reforming America’s tax code to unleash economic growth.

Adobe Acrobat document [122.1 KB]

March 11, 2015

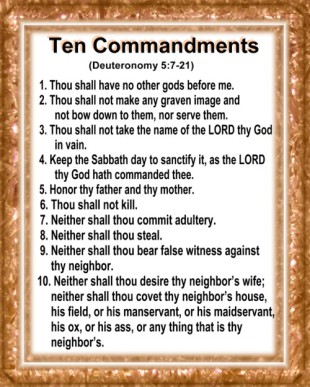

Rendering Unto Caesar: Was Jesus a Socialist?

Jesus was no dummy. He was not interested in the public professions of charitableness in which the legalistic and hypocritical Pharisees were fond of engaging. He dismissed their self-serving, cheap talk. He knew it was often insincere, rarely indicative of how they conducted their personal affairs, and always a dead end with plenty of snares and delusions along the way. It would hardly make sense for him to champion the poor by supporting policies that undermine the process of wealth creation necessary to help them. In the final analysis, he would never endorse a scheme that doesn’t work and is rooted in envy or theft. In spite of the attempts of many modern-day progressives to make him into a welfare-state redistributionist, Jesus was nothing of the sort.

Adobe Acrobat document [2.0 MB]

March 04, 2015

A Dynamic Analysis of President Obama’s Tax Initiatives

President Obama’s fiscal year 2016 budget includes a number of proposed tax increases on saving and investment and the creation or expansion of a number of tax credits. The Taxes and Growth Model finds the plan would shrink the economy by 3 percent, lower the level of investment by 8 percent, reduce wages by 3.4 percent, eliminate 809,000 jobs, and lose $12 billion in federal revenue over the long run due to lower growth. The plan’s focus on redistribution instead of growth results in a reduction of growth that would hurt many people it is meant to help.

Adobe Acrobat document [430.0 KB]

February 18, 2015

Dynamic Scoring Made Simple

Dynamic scoring is a tool to give members of Congress the information they need to evaluate the tradeoffs in tax policy changes. It provides an estimate of the effect tot tax changes on jobs, wages, investment, federal revenue, and the overall size of the economy. Using dynamic scoring, policymakers can differentiate between policies that look similar using conventional scoring methods, but have vastly different effects on economic growth under dynamic scoring. We find that five tax changes with the same static revenue cost can have vastly different effects on GDP, investment, jobs, and federal revenue. The use of dynamic scoring is crucial to ensure that comprehensive tax reform grows the economy and meets revenue expectations.

Adobe Acrobat document [676.0 KB]

February 06, 2015

The Budget Book: 106 Ways to Reduce the Size and Scope of the Government

In its long-term projections, the CBO warns that failure to get spending and debt under control include a slower economy, a national security risk, and limitations in responding to unexpected challenges. Almost half of all federal spending goes to entitlements; entitlement reform involves complex and extensive policy changes. The Heritage Foundation’s recommendations for spending reforms in the Department of Defense come with a unique caveat: any savings should be reinvested back into strengthening the country’s defense capabilities. Despite the overall Washington spending spree of the last 20 years, defense has not been adequately funded. As Congress takes up the challenge of cutting spending, these recommendations should be part of their plan. The proposals in this volume offer Members of Congress who pledged to get government spending under control specific recommendations that can make their promises concrete.

Adobe Acrobat document [2.9 MB]

January 28, 2015

The Budget Control Act and the Outlook for Defense Spending

Federal funding faced a troubled road in the remainder of 2013, including a partial government shutdown beginning October 1, 2013 owing to a failure between the House and Senate to agree to discretionary spending levels and other policy matters. On October 16 Congress passed a continuing resolution through January 15, 2014 that provided $986 billion in overall discretionary budget authority on an annualized basis for FY2014, and essentially extended FY2013 post-sequester Defense spending at $518 billion on annualized basis. However, at this funding level and in the absence of a change to the Budget Control Act, defense spending would face a $20 billion sequester in January. This is because for FY2014, the lowered spending cap for defense was $498.1 billion. The enactment of the Bipartisan Budget Act set forth defense spending limits in place for FY2014 and FY2015.

Adobe Acrobat document [1.1 MB]

December 30, 2014

Accurate Budget Scores Require Dynamic Analysis

To predict the budgetary impact of a major federal policy accurately, analysts should take into account the policy’s potential macroeconomic effects. This approach, often called “dynamic analysis,” comports with the normal scholarly practice of macroeconomic research. Academic economists do not publish predictions about macroeconomic changes that fail to take into account the interplay and feedback among relevant variables. Congressional analysts should follow the best practices of macroeconomic research by using dynamic analysis and methodological transparency. The current practice of congressional analysts, as exemplified by the Congressional Budget Office’s score of the Dodd–Frank financial law, ignores macroeconomic and even behavioral responses to the law in question, misleading Congress with the pretense of precision.

Adobe Acrobat document [142.8 KB]

December 22, 2014

Summary of Latest Federal Income Tax Data

The Internal Revenue Service has recently released new data on individual income taxes for calendar year 2012, showing the number of taxpayers, adjusted gross income, and income tax shares by income percentiles. The data demonstrates that the U.S. individual income tax continues to be very progressive, borne mainly by the highest income earners.

Adobe Acrobat document [666.0 KB]