LEFTISTS' Declaration of DEPENDENCE?

"We LEFTISTS hold these truths to be self-evident, that all men should have equal outcomes in their lives, that to secure those equal outcomes, Governments are instituted among Men, deriving their powers from that self-evident truth. That whenever any Form of Government becomes destructive of these ends, it is the Right of the People to alter or abolish it, and to institute new Government, laying its foundation on such principles and organizing its powers in such form, as to them shall seem most likely to take assets from some people and redistribute them to other people, to achieve those ends of equal outcomes in the lives and fortunes of the People. That this DEPENDENCE by the People upon Government to achieve those ends, seems most likely to effect the People's Safety and Happiness."

~Mark Holland - Corona del Mar, CA~

For Those Individuals Clamoring To Have Society’s Rewards Distributed “Equally,” Would It Be Reasonable To Expect That Society’s Burdens And Risks Be Distributed “Equally” As Well ??

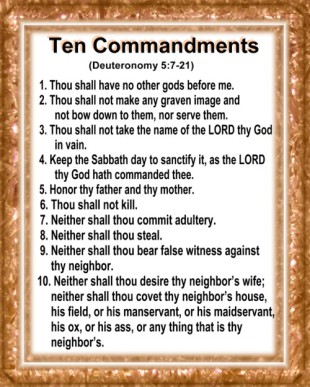

Should There Be ANY Consequences For Irresponsible Behavior And Lack Of Initiative??

Happy Birthday to the brilliant Milton Friedman. Great video from Friedman on greed. He takes the criticisms and assumptions about Capitalism and turns them around to show how they are even more applicable to government and collectivist systems. pic.twitter.com/WekgNCc01R

— Senator Rand Paul (@RandPaul) July 31, 2018

Want to close wage gap? Step one: Change your major from feminist dance therapy to electrical engineering. #NationalOffendACollegeStudentDay

— Christina Sommers (@CHSommers) November 10, 2015

March 10, 2016

Are All the Economic Gains Going to the Top 1 Percent? (From Scott Winship – Manhattan Institute)

According to many observers, incomes have stagnated for most Americans since the Great Recession, while the rich get richer. This claim, however, is based on analyses that cherry-pick start and end dates to assess income growth: the top 1 percent of households see sharper income declines during economic downturns than everyone else, and the Great Recession was especially destructive.

September 29, 2015

Would a significant increase in the top income tax rate substantially alter income inequality? (From Brookings Institution - William G. Gale, Melissa S. Kearney, and Peter R. Orszag)

“That such a sizable increase in the top income tax rate leads to a strikingly limited reduction in income inequality speaks to the limitations of this particular approach to addressing the broader challenge.”

(Does a tax structure that rewards failure and penalizes success bode well for the country ??)

August 12, 2015

Misperceiving Inequality (From Cato Institute - Vladimir Gimpelson and Daniel Treisman)

Various theories associate countries’ levels of economic inequality with important political outcomes. One argument contends that democracies with greater market-generated inequality will redistribute more. A second literature blames inequality for the outbreak of revolutions, coups, civil wars, and other forms of political violence. A third perspective sees inequality as driving the evolution of political regimes. Since elites in unequal autocracies anticipate high levels of redistribution under democracy, they fight hard to prevent it. Despite their intuitive appeal, all three theories have proved hard to substantiate empirically. According to recent reviews of the literature, inequality does not seem to matter for the politics of redistribution. Nor does the evidence suggest that economic inequality prompts political violence or change of regime type.

June 1, 2015

Who's to blame for wealth gap?

May 20, 2015

The “Income Inequality” Warriors

It is an intellectual fantasy to think that it is possible to address questions of inequality without taking into account any productivity losses that these proposals may take. Those difficulties do not arise if the first emphasis is placed instead upon the creation of wealth. Indeed it is altogether possible to improve the position of the worst off in society by a set of productive measures that widen the income gap between rich and poor.

May 16, 2015

April 8, 2015

Did a 26-year-old just take down Thomas Piketty? (From Brookings Papers – Mathew Rognlie)

An M.I.T. grad student has joined a chorus of Piketty critics, arguing that we should look to real estate to explain the explosion in wealth inequality.

March 27, 2015

The Moynihan Report 50 Years Later: Why Marriage More Than Ever Promotes Opportunity for All

Policymakers and other leaders must find ways to strengthen marriage. They can start by ensuring that policy does not undermine marriage. This can be accomplished by reducing marriage penalties prevalent in the nation’s means-tested welfare system. Furthermore, policymakers should send a clear message about the crucial importance of marriage and the intact family, particularly with regard to how strong families protect children from poverty and other risks. Leaders in all sectors should utilize their resources to strengthen and nurture health marriages. These efforts are necessary if America hopes to restore and expand opportunity for all Americans.

Adobe Acrobat document [106.8 KB]

March 13, 2015

February 23, 2015

HB 1646 Equal Pay Act Would Promote Unfair Pay for Unequal Work

In seeking to remedy a problem that does not exist, HB 1646 would be an unnecessary and costly burden on employers. The vague standards to which employers would be held would make it difficult, if not impossible, for employers to know if they are in compliance. This uncertainty would leave employers exposed to frivolous complaints and lawsuits. HB 1646 would also harm workers by creating workplaces that are less flexible and less fair. Employers would not be as willing to accommodate flexible work schedules (such as reduced hours and working from home) in exchange for lower wages. And employers would be reluctant to tie compensation to work performance, so some workers would unfairly earn equal wages for unequal work.

Adobe Acrobat document [173.5 KB]

February 13, 2015

The Impact of Economic Inequality on Economic Freedom

Inequality appears to have a negative impact on economic freedom. Ironically, while those favoring more interventionist policies in response to greater economic inequality will likely win out, the predictions that inequality will allow the economic interests of the rich to capture more of the political process will be shown to have been wrong—that is, taxes will rise, not fall. One implication is that those who wish to promote economic freedom should enthusiastically promote liberalizations that also promise to reduce inequality. Reforms that do both include educational reform, ending corporate welfare, and intellectual property reform. Proponents of free markets are often skeptical of the very philosophical meaningfulness of inequality. Regardless of how inequality should be thought of from a normative point of view, in a positive sense we may say that it inhibits the development of free economic institutions. Therefore, proponents of free markets should be opponents of inequality.

Adobe Acrobat document [190.2 KB]

February 9, 2015

Growth Versus Equality

Striking the right balance

High and rising levels of inequality will doubtless resound in the politicking leading up to the presidential election. In fact, likely Republican contenders focused on it in their responses to the president’s address. “Income inequality has worsened under this administration. And tonight, President Obama offers more of the same policies—policies that have allowed the poor to get poorer and the rich to get richer,” Sen. Rand Paul declared. Jeb Bush had the same reaction: “While the last eight years have been pretty good ones for top earners, they’ve been a lost decade for the rest of America.” And Sen. Ted Cruz said, “We’re facing right now a divided America when it comes to the economy.”

Adobe Acrobat document [833.7 KB]

January 22, 2015

Understanding Income Inequality

While there is certainly evidence of long-term wage stagnation, especially among less-skilled workers, broader measures of middle-class incomes and living standards reveal significant gains. Inequality has increased, but an exhaustive 2014 study concluded that intergenerational income mobility has been “extremely stable” for decades. Other research has likewise failed to show a serious connection between inequality and mobility, perhaps because the recent growth of American inequality has been driven by the top 1 percent of earners. If we look at inequality among the bottom 99 percent of households, U.S. and Western European levels are in the same ballpark — and America already has a more progressive tax system than the major European welfare states. Bottom line: Income inequality per se is neither “bad” nor “good.” Opportunity and mobility are far more important. The goal of U.S. policy should therefore be, not to soak the rich, but to promote the economic and cultural underpinnings of broad-based prosperity.

Adobe Acrobat document [622.8 KB]

October 29, 2014

Inequality Does Not Reduce Prosperity: A Compilation of the Evidence Across Countries

Rather than being the defining challenge of our time, as many observers believe, income inequality may be a distraction from the goal of raising living standards among the poor and the middle class. The analyses in this paper suggest that efforts to reduce inequality are more likely to damage living standards than to improve them.

Adobe Acrobat document [2.7 MB]

October 27, 2014

The Impact of Piketty’s Wealth Tax on the Poor, the Rich, and the Middle Class

In his bestseller Capital in the Twenty-First Century, Thomas Piketty recommends a wealth tax as a remedy to inequality. The basic version of Piketty’s wealth tax would impose a tax rate of 1 percent on net worth of $1.3 million and $6.5 million and 2 percent on net worth above $6.5 million. Piketty contemplates additional tax brackets, including a bracket of 0.5 percent starting at about $260,000. We used the Tax Foundation’s Taxes and Growth (TAG) model, augmented with wealth data from the University of Michigan’s Panel Study of Income Dynamics, to estimate how the U.S. economy would respond to Piketty’s wealth taxes.

Adobe Acrobat document [622.1 KB]

September 16, 2014

Whether we look at Census Bureau data on the share of total income going to the top fifth and top 5% of American households, or Census data on Gini coefficients for U.S. household income, there is absolutely no statistical support for the commonly held view by the public, academia and the mainstream media that income inequality has been rising in recent years or decades. A more accurate description of income inequality over the last several decades would be to say that it “flat-lined” starting in about 1993.

Adobe Acrobat document [400.4 KB]

September 12, 2014

Understanding Thomas Piketty and His Critics

Thomas Piketty’s Capital in the Twenty-First Century is a treatise on how wealth inequality evolves in capitalistic economies. Piketty uses data stretching back to the 18th century to describe the historical evolution of wealth and inequality, proposes a model that matches the data, and uses that model to predict rising wealth inequality in the 21st century. He recommends punitive taxes on high incomes and wealth to prevent the scenario that he predicts. However, the best critiques of Piketty have shown that most of the links in his argument are broken. Piketty’s model does not match his data as well as he claims. His prediction of permanently rising wealth inequality rests on two implausible modeling assumptions. And his recommendation of punitive taxes is based on the glib assumption that capital accumulation is unimportant for wage growth, an assumption at odds with the data and even with his own model. As a result, almost nothing in Capital in the Twenty-First Century can be applied usefully to policymaking.

Adobe Acrobat document [379.8 KB]