August 21, 2016

September 24, 2015

The Effect of State Taxes on Charitable Giving (From American Legislative Exchange Council - William Freeland, Ben Wilterdink, Jonathan Williams)

A 1 percent increase in the personal income tax burden is associated with 0.35 percent decrease in charitable giving per dollar of state income. Similarly, this State Factor found that an increase in personal income tax burden of roughly 1 percentage point of total state income results in a roughly 0.10 percentage point decrease in the level of measured charitable donations as a percent of income. When all state taxes are considered, a 1 percentage point increase in the total tax burden is associated with a 1.16 percent drop in charitable giving per dollar of state income. Similarly, an increase in total tax burden of roughly 1 percentage point of total state income results in a roughly 0.09 percentage point decrease in the level measured charitable donations as a percent of income.

August 24, 2015

The Work Versus Welfare Trade-Off – Lazy Europeans (From Cato Institute - Michael D. Tanner, Charles Hughes)

Welfare benefits in European Union (EU) countries vary widely, but in many of them, benefits are high relative to what an individual could expect to earn from a low-wage or entry-level job. Benefits in the United States fit comfortably into the mainstream of welfare states. Excluding Medicaid, the United States would rank 10th among the EU nations analyzed, more generous than France and slightly less generous than Sweden. Countries that are serious about reducing welfare dependency and rewarding work should consider strengthening work requirements, establishing time limits for participation, and tightening eligibility. Perhaps more important, countries should examine the level of benefits available and the effective marginal tax rates their welfare systems create, with an eye toward reducing disincentives and encouraging work.

May 12, 2015

The Pros and Cons of a Guaranteed National Income

Conceptually the idea of a guaranteed national income has a great deal to recommend it—especially when compared to our current complex, expensive, and ineffective welfare system. It promises an anti-poverty effort that is simple and transparent, that treats recipients like adults, and that has a better set of incentives when it comes to work, marriage, and savings. In theory, such an income could be set high enough so that no American would live in poverty. But what sounds good in theory tends to break down when one looks at questions of implementation. There are serious trade-offs among cost, simplicity, and incentive structure. Attempts to solve problems in one area would raise questions in others.

January 30, 2015

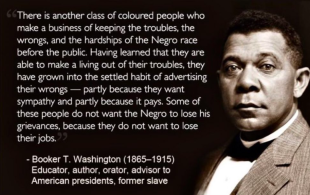

Family Breakdown and Poverty

The facts about the collapse of the family among America’s poor are uncomfortable for the Left because liberals don’t want to acknowledge what they show us about the importance of the family structure and about the need to reinforce it. And they are uncomfortable for the Right because conservatives don’t want to acknowledge what they show us about the destructive effects of persistent poverty. The promise of America is unreachable in the absence of strong and stable families. That call should now be generalized into a case for making the strength of the family a key national priority. The lessons of the past half century, and especially of the Great Society’s mostly failed experiments, can help us think more clearly about the means by which this end could be pursued. The end should be the reinforcement and recovery of the core institution of our society, and every society.

Adobe Acrobat document [3.1 MB]

January 14, 2015

Welfare in America, 1998-2013

After accounting for inflation and changes in the poverty level, the federal government now spends $1.3 trillion more on welfare than it did in 1998.The current system spends substantial sums but nevertheless leaves many millions of Americans trapped in poverty. New solutions, not more funding, are the answer. Promising reforms—such as Opportunity Grants—acknowledge this reality and seek, instead, to tap into America’s 50 state “laboratories of democracy.” Under such proposals, conservative states will have the power to implement work requirements for the able-bodied without sacrificing the level of aid received by recipients. Liberal states, for their part, can experiment with different distribution methods without sacrificing accountability. The goal: empower states to choose welfare policies that best serve their most vulnerable families, as well as those that best fit their political demands.

Adobe Acrobat document [704.7 KB]

December 12, 2014

Was Moynihan Right?: What Happens to the Children of Unmarried Mothers

Unmarried parents are not that different from married parents in their behavior. Both groups value marriage, spend a long time searching for a suitable marriage partner, and engage in premarital sex and cohabitation. The key difference is that one group often has children while they are searching for a suitable partner, whereas the other group more often has children only after they marry. Changing this dynamic would require two things. First, we would need to give less-educated women a good reason to postpone motherhood. The women who are currently postponing motherhood are typically investing in education and careers. These women use contraceptive methods that are more reliable, and they use these methods more consistently. Postponing fertility in these ways would also have benefits for women who currently do not do so. They would be more mature when they became mothers, and they would probably do a better job of selecting suitable partners.

Adobe Acrobat document [4.0 MB]

October 23, 2014

The War on Poverty Turns 50: Are We Winning Yet?

Fifty years into the War on Poverty, if we have not lost the war, we are at best barely battling to a draw. Looked at objectively, continuing the War on Poverty is unlikely to further reduce poverty, increase self-sufficiency, or expand economic mobility. More anti-poverty programs and more welfare spending are not the answer to continued poverty. Fifty years of failure is enough.

Adobe Acrobat document [526.9 KB]

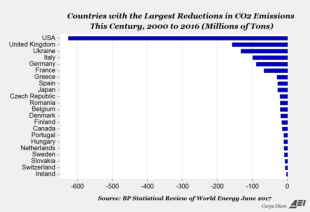

Trying to limit the burning of fossil fuels can only make energy more scarce and expensive. That has real negative consequences, especially for the poor:

October 02, 2014

Low Pay and the Cost of Living: A Supply-Side Approach

For too long an obsessive focus on the role of government transfers and state-imposed wage rates in alleviating poverty has blinded campaigners and politicians to other policy areas which fundamentally raise living costs and mean wages go less far. It is now vital that we seek to undo some of this damage, rather than doubling down with a more interventionist agenda which would seek to treat the symptoms of problems arising from existing policies.

Adobe Acrobat document [1.2 MB]

September 16, 2014

By: Robert Rector

Today, the U.S. Census Bureau will release its annual report on poverty. This report is noteworthy because this year marks the 50th anniversary of President Lyndon Johnson’s launch of the War on Poverty. Liberals claim that the War on Poverty has failed because we didn't spend enough money. Their answer is just to spend more. But the facts show otherwise.

Adobe Acrobat document [363.7 KB]